When it comes to “non-luxury” EV sales, Tesla’s still the gorilla in the room. According to Experian, the company controlled 46.89% of the U.S. EV market in Q2 2025. The rest of the pie is a knife fight among legacy brands and in a striking reversal, Chevrolet has muscled its way past Ford to become the domestic nameplate to watch.

Chevy’s climb didn’t happen overnight. It’s the payoff from a portfolio that covers the pragmatic end of the market (Bolt, Equinox) while signaling capability at the high end (Hummer EV, Silverado EV) plus a distribution network that can service what it sells. Where Ford burst out with splashy early movers, Chevy played the long game, tightened execution, and in 2025 is reaping the result: momentum and market share.

Ford came out of the gate strong with its 2022 EV sales

Back in 2022, Ford looked like the heir apparent. F-150 Lightning launched into America’s favorite vehicle segment. Mustang Mach-E gave shoppers a spirited, American alternative to the Tesla Model Y. By Q2 2022, Ford’s non-luxury EV share reached 28.42%. Then came a strategic pivot less about iterating the winners, more about re-tooling for a next-gen compact electric truck and a new manufacturing approach inspired by Tesla. While that long-term bet may yet pay off, it left daylight for rivals. Ford’s share eased to 20.61% in Q2 2023, 19.72% in Q2 2024, and a surprising 13.48% in Q2 2025.

During the same period, Hyundai’s ride up and then down shows how fragile EV momentum can be. Its share peaked at 22.18% before slipping to 17.01% amid durability anxieties tied to a major recall. The lesson: one or two missteps in an early market can quickly rewrite the leaderboard.

The quiet, consistent winner: Chevrolet

Chevy, Ford’s cross-town rival, spent 2022 in the middle of the pack at 12.97% share. Three years later, the positions have practically swapped: in Q2 2025, Chevrolet owns 25.9% of U.S. non-luxury EV sales. That’s not just “doing well” that’s category-defining traction.

What changed? A few levers, pulled deliberately:

- Right-sized nameplates. Rather than chase Tesla model-for-model, Chevy filled gaps consumers actually felt. The Bolt gave price-sensitive shoppers a real EV with real range. The Equinox EV hits the crossover sweet spot where families live.

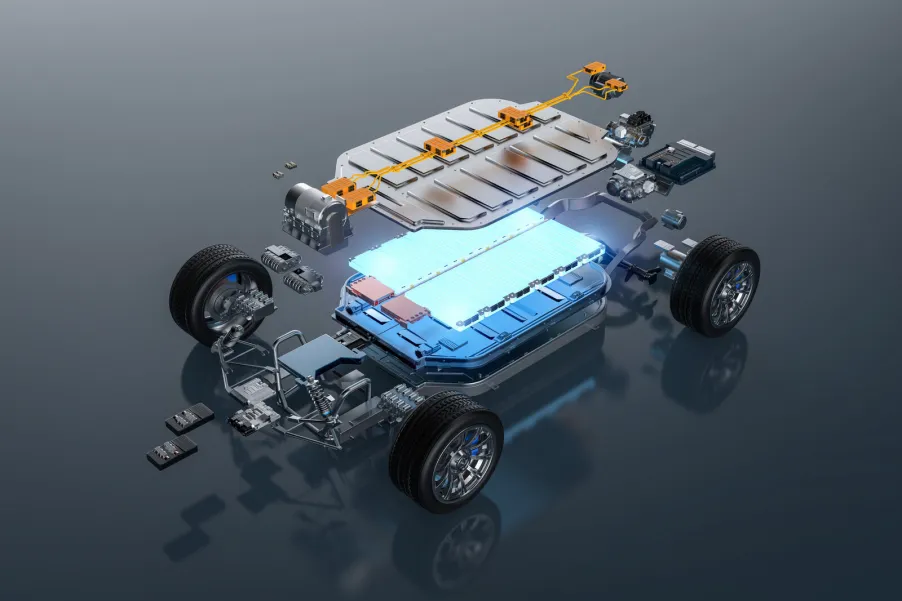

- Breadth signals strength. Though not counted in “non-luxury,” halo products matter. The Hummer EV and Silverado/Sierra EV demonstrate headroom in capability and tech; Cadillac’s growing lineup (up to and including the ultra-premium Celestiq) projects EV seriousness across the General Motors house. That halo flows down to Chevy’s showroom conversations.

- Dealer network and service capacity. Early adopters tolerate hiccups; mainstream buyers don’t. Chevy’s large dealer footprint and the training/parts pipeline that comes with it—gives many buyers confidence that ownership won’t be a science experiment.

- Tax-credit alignment and pricing discipline. Consumers shop the out-the-door number. Consistent eligibility for incentives and steady, transparent pricing reduce friction at the last mile.

Model mix that meets the moment

Chevy’s EV story isn’t a single hero model; it’s a ladder.

- Bolt/Bolt EUV (legacy value play): Even with discontinuities, the Bolt family set the tone: attainable EVs that don’t feel compromised. For shoppers crossing over from compact gas cars, it normalized EVs as “just a car” with a plug.

- Equinox EV (mainstream crossover): The heart of the market. It’s the direct Model Y rival in form factor and use case, but tuned to Chevy’s audience and price points. According to Electrek, the Equinox is the best-selling non-Tesla EV in the U.S., a signal that Chevy’s read on the middle market is resonating.

- Silverado EV / Sierra EV (full-size trucks): While these sit at higher price tiers, they matter symbolically and practically. They keep truck-loyal buyers within the GM universe as fleets and individuals test towing, payload, and charging realities.

- Hummer EV (halo): Excessive? Absolutely—and intentionally so. It proves the Ultium platform’s headroom, grabbing attention while engineering teams harden components for the mass market.

Why Ford stalled & how Chevy capitalized

Ford’s early wins created expectations. But EVs are a “ship fast, iterate faster” category. Pausing to reinvent factories and chase a future compact pickup left the current lineup aging against competitors that continued to tweak, re-price, and expand trims. Meanwhile, supply-chain fits and starts, dealer markups, and evolving pricing on the Lightning and Mach-E confused shoppers. In a high-consideration purchase, confusion is conversion-poison.

Chevy’s advantage wasn’t perfection; it was consistency. Fewer whiplash price moves. Clearer trim walk. Regular software and feature updates. And crucially, inventory and service that met mainstream expectations in more ZIP codes. Buyers comparing two decent EVs will pick the one they can actually test drive this weekend and service in town.

The numbers tell the story

- Tesla (non-luxury segment context): 46.89% in Q2 2025 still towers over the field—no one should pretend otherwise.

- Ford: 28.42% (Q2 2022) → 20.61% (Q2 2023) → 19.72% (Q2 2024) → 13.48% (Q2 2025).

- Hyundai: Up to 22.18%, then down to 17.01% after recall turbulence.

- Chevrolet: 12.97% (Q2 2022) → 25.9% (Q2 2025), the standout gainer among domestic non-luxury EV sellers.

Those lines don’t just cross they diverge. Chevy now owns roughly one out of every four non-luxury EV sales in America, trailing only Tesla in the broader conversation.

What “Chevy EV market share” means for buyers & what’s next

For shoppers, Chevy’s larger share translates to more leverage and more choice. You’re more likely to find the trim and color you want within driving distance. Incentive stacks tend to be richer where competition is tight and inventory is healthy. Service learning compounds as more Equinoxes and Bolts hit the road, improving turnaround times and diagnosis accuracy.

For the market, it signals maturation. The EV conversation is moving beyond “firsts” and “wow features” to boring, beautiful fundamentals: price, availability, reliability, residual values, and total cost of ownership. Chevy’s share growth suggests it understands that center of gravity and is building for it.

Looking forward, keep an eye on three pressure points:

- Charging experience. As more brands adopt the same fast-charging standard and open access to broader networks, the differentiator becomes uptime and peak charge rates. Chevy must continue to hit real-world numbers that match the brochure.

- Software quality and OTA cadence. UX glitches can undo hardware goodwill. Frequent, meaningful over-the-air updates will be table stakes.

- Cost discipline. Battery inputs, logistics, and warranty reserves can eat margins fast. Maintaining value pricing without eroding quality will decide how durable this share is.

Conclusion

In the battle for non-luxury EV buyers, Chevy has moved from contender to pace-setter, quietly flipping the script on Ford over three years. Tesla still rules the hill, but if you’re searching for “Chevy EV market share” to understand who’s actually winning hearts, garages, and spreadsheets in 2025—the data points one way. Chevy’s not just wrestling share away; it’s learning how to hold it.

Related: Porsche vs. Luxury SUVs: Where Emotion, Utility, and Status Collide