From Hyper-Growth Darling to First Annual Sales Drop

For more than a decade, Tesla was the poster child of nonstop growth. Every year meant more factories, more deliveries, more headlines. That streak quietly broke in 2024.

Company data show Tesla delivered about 1.79 million vehicles in 2024, slightly below the 1.81 million it sold in 2023 – a 1.1% annual decline, its first drop in at least nine years.

On paper, a 1.1% fall doesn’t sound catastrophic, but symbolically it’s huge. Tesla built its valuation on the assumption of relentless expansion. A flat-to-down year signals that the easy growth phase is over. The company is now wrestling with:

- Slower EV adoption in some markets

- An ageing product lineup (Model 3/Y are no longer “new”)

- Cheaper, aggressive rivals, especially from China

- A more controversial brand image tied to Elon Musk

In other words, Tesla is no longer the only cool EV in town – it’s just one of many options, and not always the best-priced one.

2025: When the Slump Becomes Hard to Ignore

If 2024 was a warning shot, 2025 turned it into a trend. In the first quarter of 2025, Tesla’s vehicle deliveries dropped about 13% year-over-year, to roughly 336,000 vehicles, its weakest quarter in almost three years and far below analyst expectations.

The pain didn’t stop there. Data for the second quarter of 2025 show another double-digit fall – Tesla’s deliveries declined around 14% year-over-year, marking its largest quarterly drop on record.

Ironically, Q3 2025 looked better on the surface: Tesla delivered around 460–500k vehicles, hitting or beating forecasts and even setting a quarterly record. But that rebound followed two weak quarters, and analysts still expect full-year 2025 deliveries to be roughly 10% below 2024, around 1.6 million vehicles.

So yes, there are short bursts of good news, but the bigger picture is clear: the growth curve has bent downward.

Europe Turns Its Back on Tesla

One of the most brutal stories is unfolding in Europe. While European EV and hybrid sales overall continue to grow, Tesla itself is going backwards.

Between January 2024 and January 2025, Tesla’s European sales plunged around 45%, with EU registrations down roughly 50%. The Washington Post+1 In some key markets:

- UK registrations fell nearly 60% in a single month comparison.

- Germany and other major countries saw similar double-digit drops.

What makes this more alarming is that it’s not because Europeans suddenly hate EVs. Battery-electric and hybrid vehicles are taking record market share across the continent; Tesla is simply losing its slice of the pie while competitors – including Chinese brands like BYD and traditional OEMs – move in with cheaper, fresher models.

In short: the market is healthy, but Tesla’s position inside it is not.

It’s Not Just “EV Slowdown”: Competition, Prices and Politics

A lot of headlines blame a generic “EV slowdown,” and there is some truth: global electric car growth cooled from 40% to about 10% in 2024. IEA+1 But for Tesla, the problem is more specific and more complicated.

1. Fierce competition and price pressure

Tesla used to have the field almost to itself. Now, it faces:

- Chinese EV makers (especially BYD) that sell competitive cars at lower price points and are rapidly expanding in Europe and other markets.

- Legacy carmakers (VW, Hyundai, GM, Ford, etc.) with growing EV lineups and strong dealer networks.

To defend its volume, Tesla slashed prices repeatedly through 2023–2024. That strategy helped keep cars moving out of showrooms, but it hammered profit margins, pushing automotive gross margin down to the mid-teens and cutting earnings by more than 40% in some quarters.

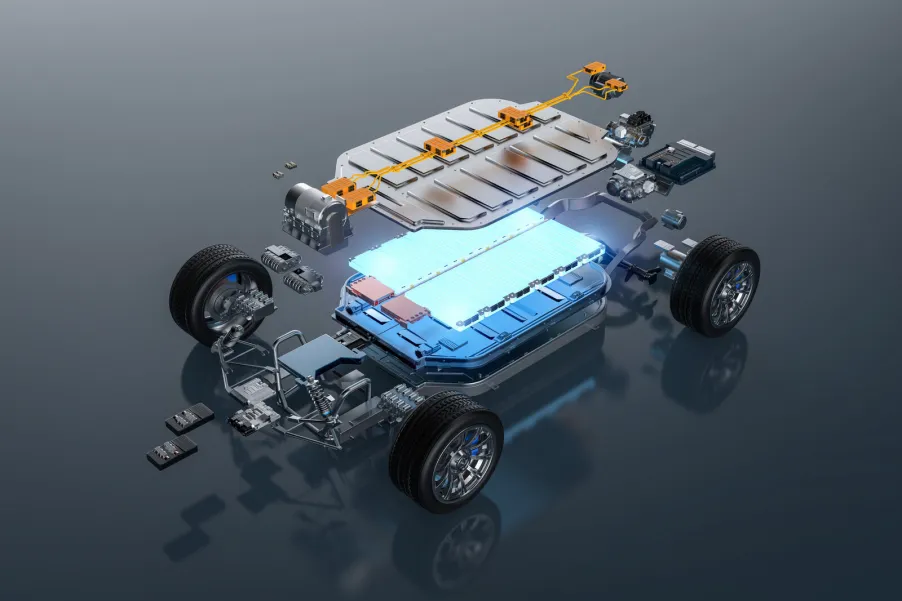

2. Ageing lineup and delayed new models

The core lineup – Model 3, Model Y, S, X – is aging. Apart from refreshes and the niche Cybertruck, Tesla has not launched a genuinely new mass-market model in years. Meanwhile, rivals flood the market with crossovers, compacts and cheaper city EVs.

Analysts repeatedly argue that Tesla needs a sub-$30,000 “Model 2”-type car to reignite demand, especially as buyers become more price-sensitive in a high-interest-rate world. Tesla has talked about such a car and a low-cost next-gen platform, but actual launch timing keeps shifting.

3. Elon Musk’s politics and brand damage

In 2025, many reports explicitly tie Tesla’s sales slump – especially in Europe – to backlash against Elon Musk’s political activity, controversial social media behavior, and public alignment with far-right parties and Trump-aligned politics.

For a brand originally built on climate optimism and tech-forward progressives, that shift matters. Some environmentally minded buyers are simply choosing other EVs that don’t come with the Musk baggage.

Price Cuts, Shrinking Margins and Nervous Investors

To keep sales from falling faster, Tesla has leaned heavily on discounts, incentives and price cuts. These moves:

- Lower the average selling price (ASP) of its vehicles – analysts estimate ASP fell to just over $41,000 in late 2024, the lowest in years.

- Compress operating margin, which peaked around 16–17% in 2022 but has slid toward single digits, with some quarters near 6–7%.

The result: Tesla sometimes posts record deliveries and higher revenue, while profits and margins go the opposite way. Investors are now asking two tough questions:

- If sales are down or flat even after heavy price cuts, what happens when Tesla can’t cut prices any further?

- If margins stay low, can Tesla still justify its premium tech-stock valuation, rather than being valued like a normal automaker?

That tension is why Tesla’s share price tends to swing violently around each delivery and earnings report – every quarter is a referendum on whether this is just a temporary dip or the new normal.

Can Tesla Turn the Story Around?

Despite all the red flags, writing Tesla off would be premature. The company still:

- Sells more EVs globally than any other single brand.

- Has huge manufacturing scale, a powerful Supercharger network and strong software capabilities.

- Is expanding into energy storage, AI, robotaxis and robotics, trying to build multiple revenue streams beyond car sales.

The big open questions are:

- New affordable model: Can Tesla actually launch a cheaper, mass-market EV (~$25–30k) fast enough to win back budget-conscious buyers before competitors lock in loyalty?

- Robotaxis & autonomy: Will self-driving and robotaxis become a real, scaled business – or remain an endlessly delayed promise?

- Brand reset: Can Tesla separate the product from the controversies surrounding its CEO, or will Musk’s personal brand keep dragging sales down in key regions?

Related: Tesla Faces Lawsuit Alleging Doors Trapped Five in Fiery Crash

Right now, “Tesla sales down” is more than a headline – it’s a signal that the company has entered a tougher, more mature phase of its life. The hyper-growth chapter is closing. The next chapter will be about whether Tesla can evolve from high-flying disruptor into a resilient, diversified, and genuinely competitive global manufacturer in a crowded EV world.