A sudden swerve in Honda’s EV roadmap

Honda has reportedly shelved development of a large, three-row electric SUV that was slated for a U.S. launch around 2027, pivoting instead to hybrids as consumer appetite for big, pricey EVs cools. Multiple industry outlets, citing Nikkei reporting, say the project was part of Honda’s next wave of battery-electric vehicles targeting North America—an SUV positioned to square off against the Kia EV9 and similar three-row entrants. That launch is no longer happening, at least not on the original timetable or in the originally envisioned form.

What exactly got canceled and what didn’t

The decision specifically affects the large SUV program; it doesn’t mean Honda is abandoning all EVs. Reporting indicates Honda still intends to introduce smaller 0-Series models, including a midsize SUV and a sedan that were previewed previously. Those remain on the roadmap, while the most ambitious and expensive three-row vehicle is the one on ice. In short: the top-end halo family hauler is out; the more attainable EVs are still in play.

Why now: demand, incentives, and pricing reality

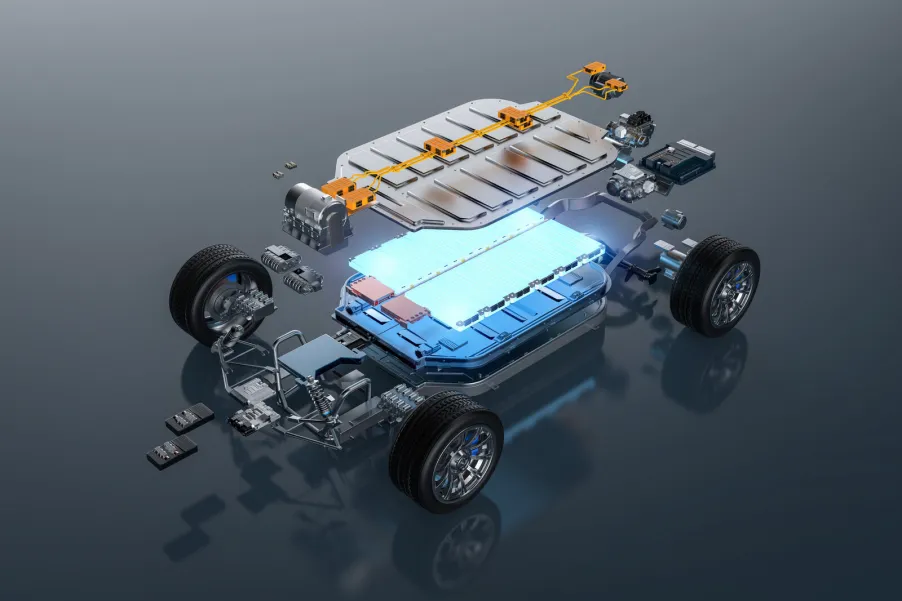

The U.S. EV market has slowed from its breakneck growth, and large, premium-priced electric SUVs are the toughest sell when incentives waver and interest rates bite. Analysts point to cooling demand for high-ticket EVs, uncertainty around federal tax credits, and the broader cost equation (battery inputs, distribution, and financing) as key drivers behind Honda’s decision. For buyers at the $60–80K price point, the loss or reduction of a $7,500 federal credit can be decisive, tilting monthly payments toward similarly sized hybrid or gasoline rivals. Honda’s call mirrors a pattern across automakers that are stretching timelines and re-sequencing EV launches as the near-term economics wobble.

The hybrid pivot: short-term volume, lower risk

Honda isn’t exiting electrification, it’s sequencing it. The company has already said it will lean into hybrids in the U.S. to bridge today’s buyer preferences with tomorrow’s full electrification, even as it trims near-term EV capital outlays. In May, Honda telegraphed a plan to expand next-gen hybrid offerings in the late-2020s while reducing total electrification investment through roughly 2030. That “walk, then run” stance lowers risk, preserves margin, and keeps showroom traffic flowing with models like the Civic, Accord, and CR-V hybrids that already resonate with mainstream buyers.

What it means for Honda’s U.S. lineup right now

Today’s U.S. strategy centers on hybrids for scale and select EVs for presence. Honda’s Prologue (a midsize EV co-developed with GM) continues to be produced in Mexico, while Acura’s ZDX (built by GM in Tennessee) is being wound down as Honda recalibrates its premium EV approach. In practice, that means the most visible three-row EV flagship Honda had in mind won’t be the spearhead; instead, expect hybrid growth and more incremental EV entries as infrastructure, policy, and costs stabilize.

Industry echo: Honda’s not alone

Honda’s move is part of a broader re-rating of EV ambitions in North America. Several automakers have delayed, trimmed, or reshaped EV rollouts as the 2024–2025 market failed to meet prior hockey-stick projections. Reports throughout 2025 highlight model cancellations or pauses, notably in the three-row and luxury segments where batteries are largest and price sensitivity is sharpest. The pattern underscores a tactical retreat: keep EV R&D alive and focused, but sequence launches where incentives are durable, charging is dense, and consumer math works.

The strategic calculus: timing, not surrender

Viewed strategically, canceling a large EV SUV now may be less about capitulation and more about option value. A halo three-row EV demands sizable battery capacity, premium interiors, and cutting-edge driver-assist tech—stacking cost on cost. If the total addressable market is temporarily constrained by policy whiplash and charging anxiety, the ROI shrinks. By postponing the most capital-intensive EV, Honda buys time to ride the battery cost curve down, digest evolving U.S. emissions policy, and launch when utilization of incentives (state or federal) is clearer. That logic aligns with Honda’s publicly stated step-down in EV investment and increased emphasis on hybrids as a bridge technology.

Winners and losers: consumers, dealers, and rivals

For consumers, the near-term impact is mixed. Shoppers looking for a Honda-branded three-row electric will have fewer native options; they may gravitate to rivals’ offerings—or choose a hybrid three-row to maintain space and range while keeping payments in check. Dealers benefit from inventory that turns (hybrids), while avoiding slow-moving $70K EVs that require complex customer education and at-home charging readiness. Rivals with a full-size EV already in market face two realities: less direct Honda competition in the short run, but also a signal that price discipline and feature-rich hybrids could peel away buyers who were on the fence about going fully electric this year.

What to watch next: 0-Series cadence and tax policy

Keep an eye on three threads:

- 0-Series timing—Honda’s midsize EV SUV and sedan will test whether a slightly smaller, less battery-hungry format can hit today’s value sweet spot.

- Federal and state incentives—Any clarity or changes in credits can materially shift demand curves up or down.

- Charging build-out and rates—As fast-charging reliability improves and electricity pricing stabilizes, the ownership math for larger EVs gets friendlier. If these variables trend positive, expect Honda (and others) to re-open the playbook for larger EVs later in the decade.

Related: Turning a Legend into a Beast: The Blazin Rodz 1969 Chevrolet Camaro Hybrid Hypercar

Conclusion

Honda’s cancellation of its large U.S. electric SUV is a tactical retreat, not an abandonment of EVs. It reflects present-day realities cooler demand, shifting incentives, and steep battery costs and a bet that hybrids can carry the brand’s sales and profitability while the EV market resets. For shoppers, it means more excellent hybrid choices now and a steadier, perhaps smarter EV rollout later. For the industry, it’s another reminder that the transition won’t be a straight line—even for a company as deliberate and engineering-driven as Honda.