The phrase automakers EV no longer refers to a niche experiment or a distant promise. It now represents a full-scale transformation of the global automotive industry. Established manufacturers and newer innovators are racing to redefine how vehicles are designed, built, powered, and sold. What makes this shift remarkable is not just the technology itself, but the diversity of approaches automakers are taking—ranging from affordable mass-market cars to luxury sedans and high-performance electric trucks.

Electric mobility has moved beyond early adopters. Today, it reflects a strategic recalibration by automakers responding to tightening emissions regulations, shifting consumer expectations, and rapid advances in battery and software systems.

The Strategic Shift Behind Automakers’ EV Commitments

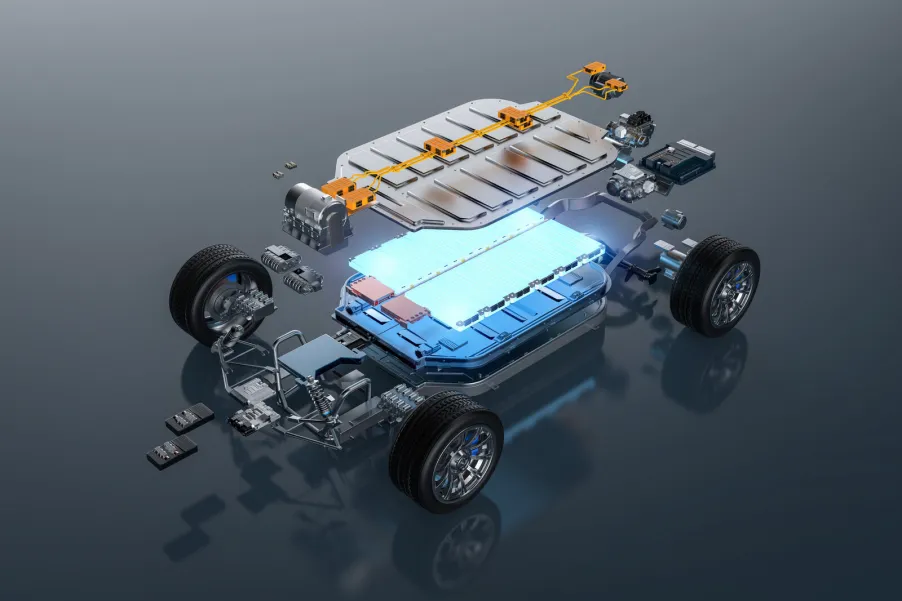

For decades, internal combustion engines dominated global transportation. The transition to electric vehicles required automakers to rethink supply chains, manufacturing processes, and even brand identity. Battery sourcing, charging ecosystems, and software integration now matter as much as horsepower and styling once did.

Unlike past powertrain transitions, this shift is happening simultaneously across continents. Governments in Europe, North America, and Asia are pushing stricter emissions targets, while consumers increasingly expect cleaner, quieter, and more connected vehicles. Automakers that once hesitated are now committing billions of dollars to electrification programs.

Leading Automakers Driving the EV Market

Several manufacturers have emerged as clear leaders, not only because of sales volume but due to their influence on market perception and infrastructure development.

Tesla remains one of the most influential names in electric mobility. Models like the Model 3 and Model Y helped normalize EV ownership by combining long range, performance, and access to a widespread charging network.

BYD has quietly become a global powerhouse. With vehicles such as the Atto 3, Dolphin, and Seal, BYD dominates EV sales in China and continues expanding internationally, supported by its in-house battery technology.

Hyundai and Kia have built strong momentum through models like the Ioniq 5, Ioniq 6, EV6, and EV9. Their success lies in blending distinctive design, competitive pricing, and practical range.

The Volkswagen Group spans multiple brands, offering everything from the VW ID.4 to the Skoda Enyaq and Audi e-tron lineup. This multi-brand strategy allows the group to address both mainstream and premium EV buyers.

Luxury manufacturers such as BMW and Mercedes-Benz are translating decades of brand equity into electric form with the BMW i-series and Mercedes EQ lineup, focusing on refinement, performance, and advanced driver assistance systems.

Traditional Automakers Reinventing Themselves

Long-established automakers have had to balance existing combustion-engine portfolios with aggressive EV investments.

Ford made headlines with the F-150 Lightning, an electric version of America’s best-selling pickup. Its success demonstrated that EVs could appeal to traditionally conservative truck buyers.

General Motors has taken a platform-driven approach, introducing models like the Hummer EV while planning a broad lineup across Chevrolet, GMC, and Cadillac.

European brands such as Renault, Volvo, Skoda, and MG Motor have also accelerated EV rollouts, particularly in price-sensitive and urban-focused segments.

New Entrants and Focused Innovators

The EV era has lowered barriers to entry, allowing startups to challenge legacy brands.

Rivian focuses on electric trucks and SUVs aimed at adventure-oriented buyers. Lucid Motors targets the luxury sedan market with a strong emphasis on range and efficiency. Polestar, backed by Volvo, blends minimalist design with performance-driven engineering.

Chinese manufacturers such as NIO and XPeng are also gaining recognition for advanced software, driver assistance features, and competitive pricing.

In emerging markets, companies like Tata Motors and Mahindra are making EV ownership accessible with locally produced models, highlighting how electrification is not limited to premium segments.

Comparing EV Approaches Across Automakers

| Automaker Category | Core Strength | Typical Buyer Focus |

|---|---|---|

| EV-first brands | Software, charging, range | Tech-forward consumers |

| Legacy automakers | Manufacturing scale, service networks | Mainstream buyers |

| Luxury brands | Refinement, performance | Premium customers |

| Regional players | Affordability, local needs | Emerging markets |

This diversity underscores that there is no single formula for success. Automakers tailor their EV strategies based on market maturity, infrastructure, and brand positioning.

Ownership Implications and Practical Considerations

Consider a family comparing a gasoline SUV with an electric alternative from a legacy automaker. They value dealership support, predictable servicing, and familiar controls. An EV from a traditional brand offers reassurance while still delivering quieter driving and lower running costs. That balance is precisely where many automakers are finding traction.

I remember test-driving an electric crossover from a brand I’d trusted for years and realizing how seamlessly it fit into everyday driving without feeling experimental.

What Sets Successful Automakers Apart

The strongest value automakers bring to the EV space is not just battery capacity or acceleration figures. It’s their ability to integrate technology with reliability, service access, and long-term support. Buyers are increasingly looking beyond range numbers to consider warranty coverage, software updates, charging partnerships, and resale value.

Automakers that communicate transparently, handle recalls responsibly, and invest in charging ecosystems are building trust that extends beyond individual models.

Related: Why Tesla Sales Are Finally Falling – And What It Really Means

Conclusion

Automakers EV strategies reflect a global industry in transformation. From market leaders and legacy manufacturers to agile startups and regional players, the competition is reshaping transportation at every level. While approaches differ, the direction is clear: electrification is no longer optional. For consumers, this means more choice, better technology, and vehicles that align with both practical needs and environmental goals.

FAQs

Are traditional automakers behind EV-only brands?

Not necessarily. Many legacy automakers leverage manufacturing experience and service networks to compete effectively.

Which automaker sells the most EVs globally?

Chinese manufacturers, particularly BYD, currently lead global EV sales volume.

Are luxury EVs worth the price?

They often offer superior refinement, performance, and technology, appealing to buyers prioritizing comfort and brand prestige.

Do emerging-market automakers matter in the EV space?

Yes. They play a critical role in making electric vehicles affordable and accessible worldwide.

Will all automakers eventually go fully electric?

Most major manufacturers have announced long-term plans to significantly reduce or eliminate combustion engines, though timelines vary.